🖼️ Tool Name:

FloQast

💰 Pricing Model:

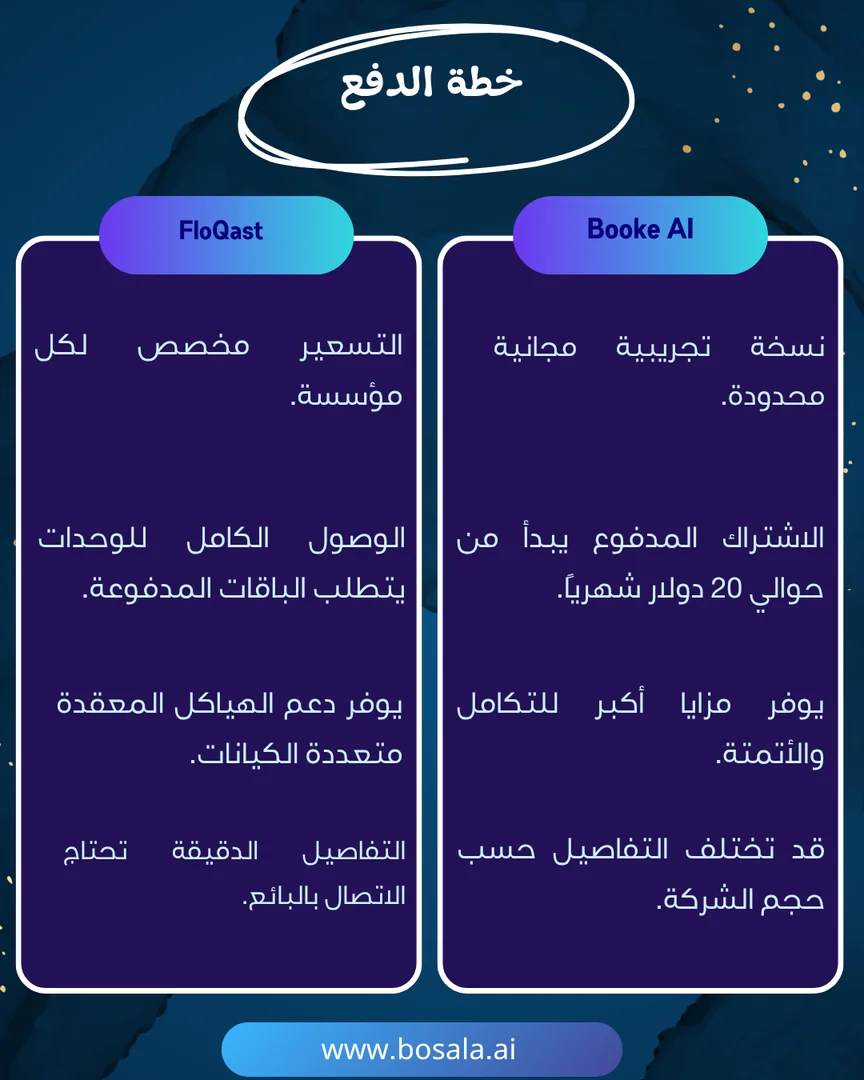

Subscription-based enterprise model; specific pricing not broadly published (custom per organization).

🆓 Free Plan Details:

Not publicly detailed; likely requires contacting vendor for demo/trial.

💳 Paid Plan Details:

Paid tiers unlock full modules (close management, reconciliation, compliance, AI agents) and support for multi-entity, global, complex structures.

🔖 Tool Category:

AI-powered accounting close management & workflow automation platform; falls under Finance, Forecasting & Dashboards (primary) and Business Docs Automation (secondary).

✏️ What does this tool offer?

FloQast is designed to help accounting and finance teams manage, streamline, and automate the month-end/quarter-end/annual close process. It provides checklists, dashboards, task tracking, reconciliation workflows, and integrations with ERP systems and collaboration tools.

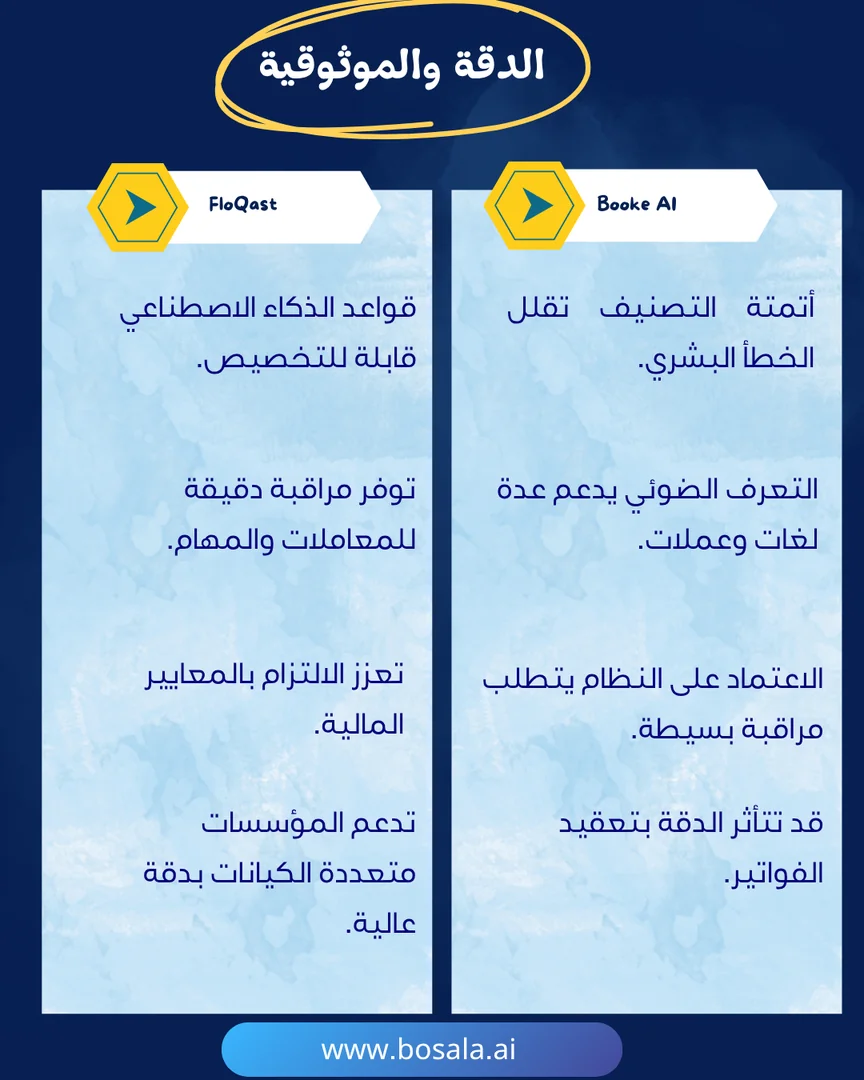

It leverages AI and automation to reduce repetitive tasks and improve visibility and audit readiness.

⭐ What does the tool actually deliver based on user experience?

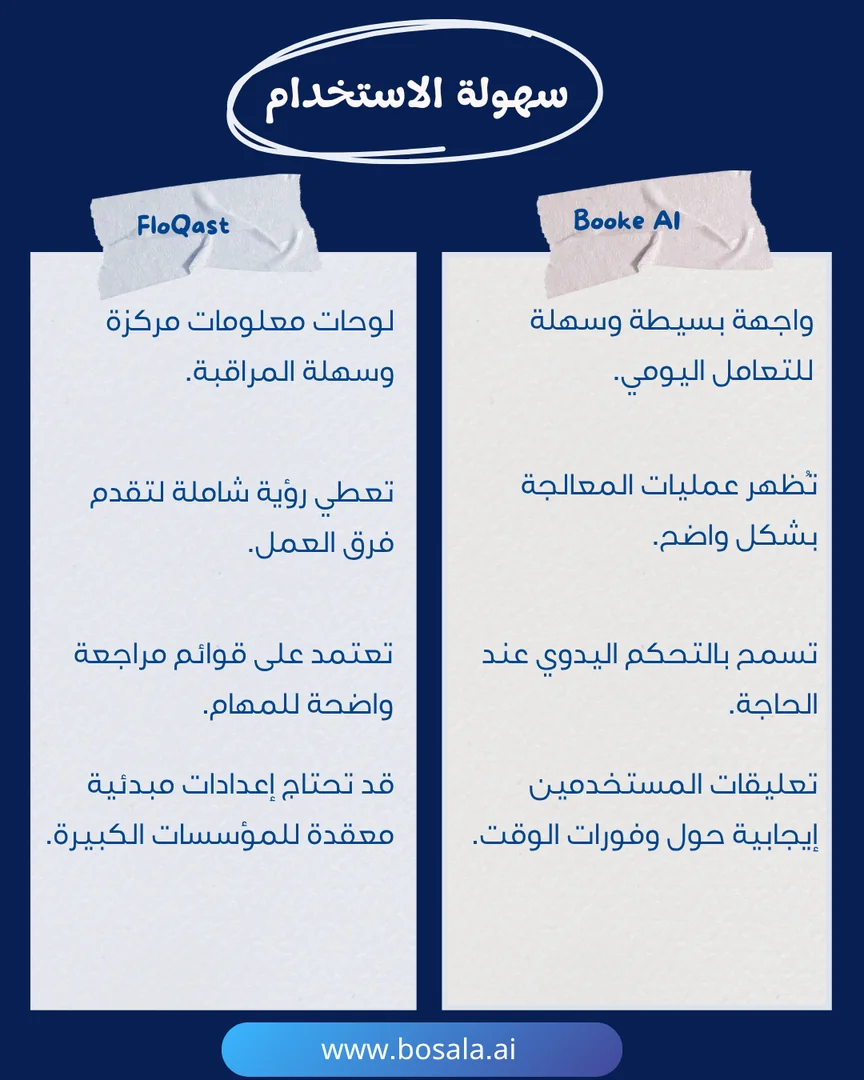

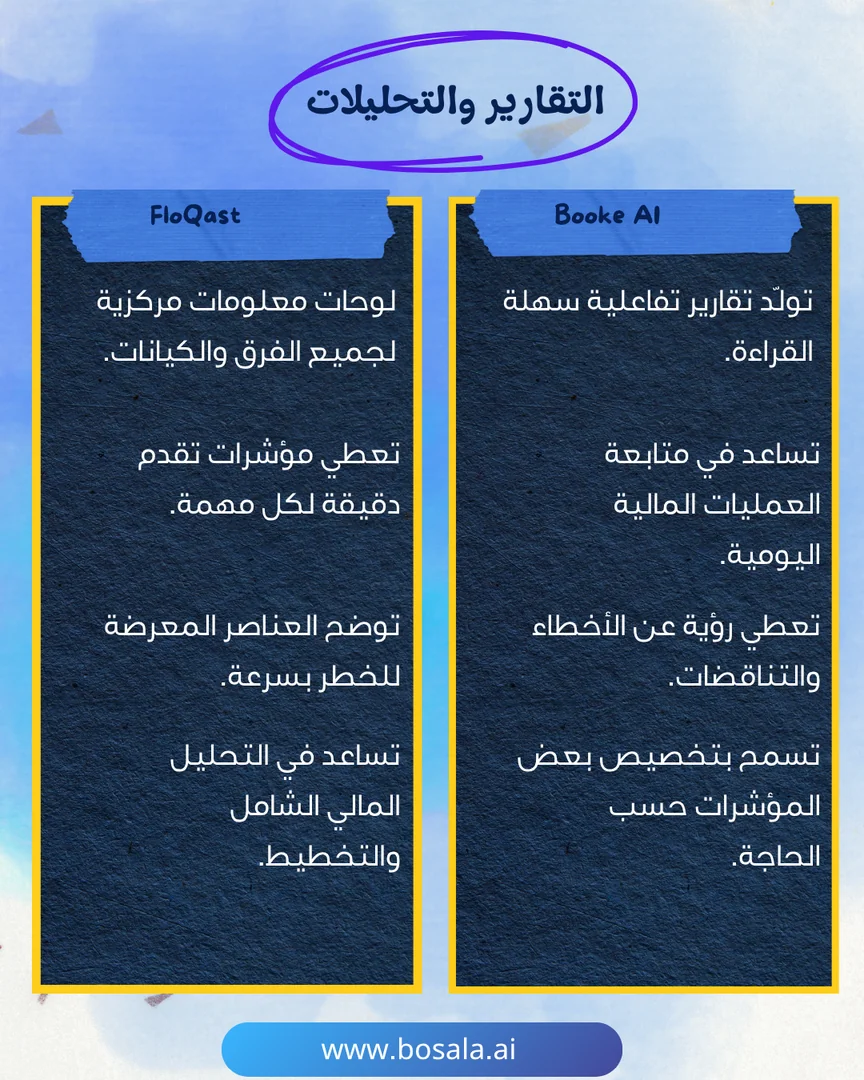

• Centralized close-management checklists and task tracking, showing status of preparers, reviewers, sign-offs.

• Dashboard views of progress across entities, teams, tasks and flags for at-risk items

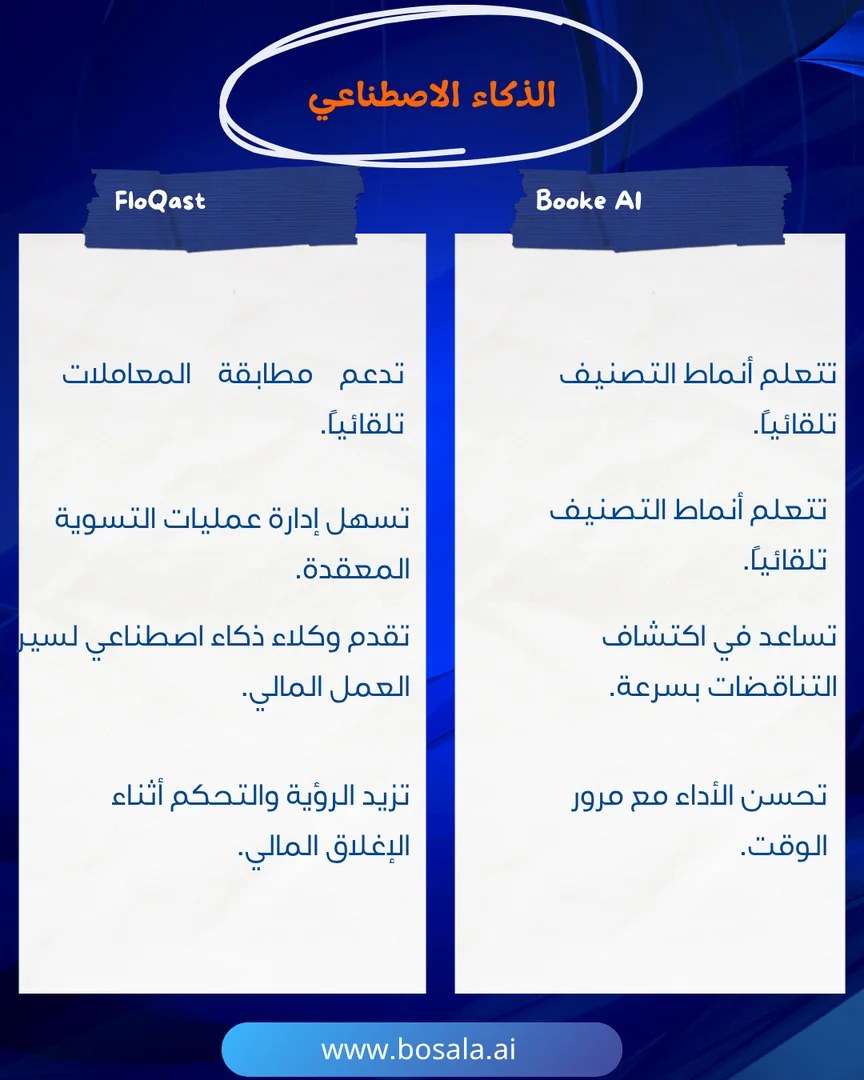

• Automation and AI-assisted features such as transaction matching, reconciliations, and AI agents for finance workflows.

• Integrations with major ERPs, Excel/Google Sheets, storage and collaboration platforms — so finance teams can work in familiar environments.

🤖 Does it include automation?

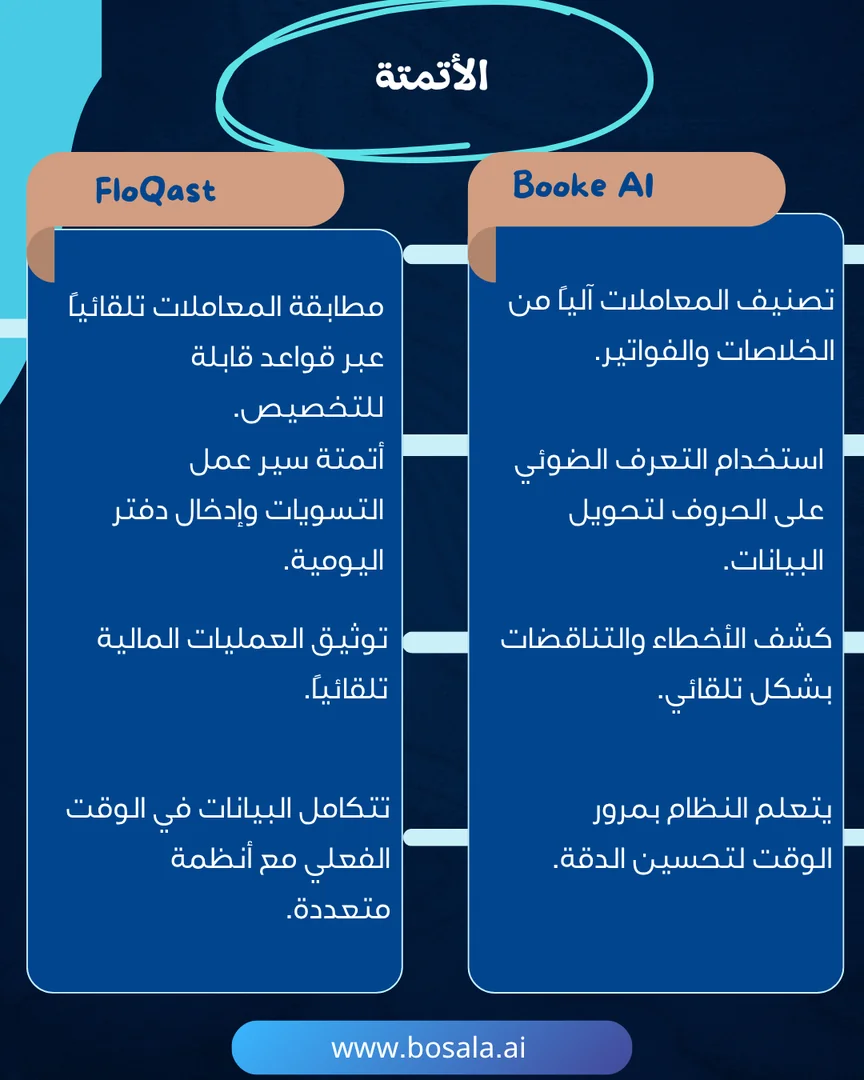

Yes — FloQast includes multiple automation capabilities:

• AI-driven transaction matching across data sources, customizable rules in natural language.

• Automation of reconciliation workflows, journal entry management, and audit documentation.

• Continuous integration of data from ERPs/banks/storage and real-time visibility/control.

💰 Pricing Model:

Subscription-based enterprise model; specific pricing not broadly published (custom per organization).

🆓 Free Plan Details:

Not publicly detailed; likely requires contacting vendor for demo/trial.

💳 Paid Plan Details:

Paid tiers unlock full modules (close management, reconciliation, compliance, AI agents) and support for multi-entity, global, complex structures.

🧭 Access Method:

• Web-based platform via FloQast’s website.

• Integrates with your accounting systems/ERP and Excel/Sheets workbooks, enabling finance teams to work within familiar tools.

🔗 Experience Link:

https://www.floqast.com