Nuvio

Description

🖼️ Tool Name:

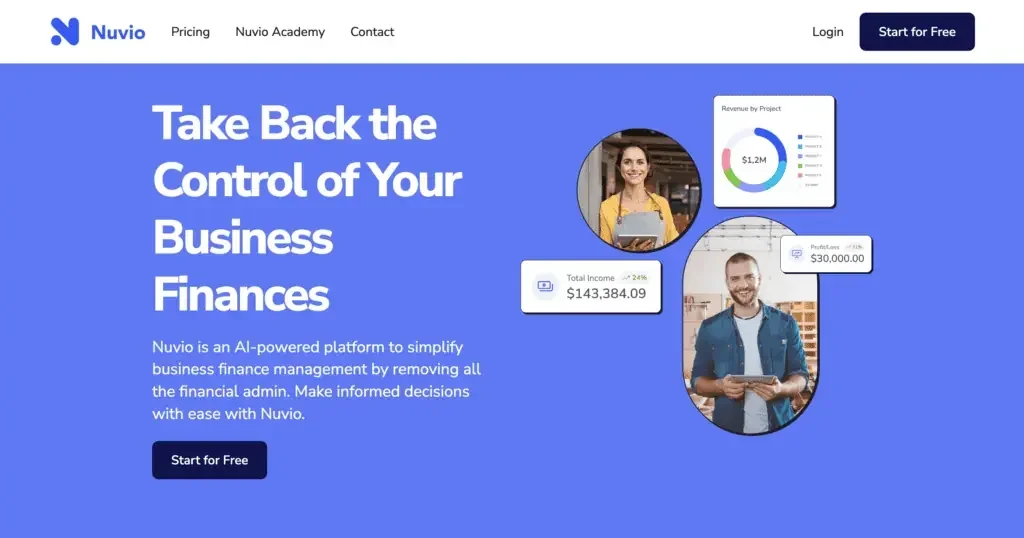

Nuvio (sometimes Nuvio AI)

🔖 Tool Category:

AI-powered financial tracking & analytics / Virtual CFO tool — fits under Finance Automation, Data & Analytics, Business Management

✏️ What does this tool offer?

Consolidates income, expenses, cash flow, and bank transactions into a unified dashboard so businesses don’t jump between multiple tools.

Lets users ask natural-language financial questions (“What was my cash flow last month?”, “Forecast burn rate for next quarter”, etc.) and get instant insights.

Predictive analytics: forecasts future cash flow, helps spot potential financial issues before they become big problems.

Open API and flexible data tables (customizable viewing/sorting/exporting of financial data) to integrate with other tools.

Dashboards & visual reports ready-made, with simplified financial metrics (income vs expense, clients, suppliers etc.).

⭐ What does the tool actually deliver based on user experience?

• Much faster into insights: what took hours manually now becomes seconds. Users of small businesses / startups report significant time savings.

• Better financial visibility: easily filtering and seeing key financial metrics (income, expenses, cash flow) in context.

• Predictive foresight helps with planning — e.g. anticipating cash shortages in advance.

• More control over financial reporting: customizing which data to see, adjusting reports, reorganizing tables.

🤖 Does it include automation?

Yes — here are some automated features:

Automatic ingestion of bank account & transaction data so that income/expense tracking is smooth and up to date.

Automated prediction / forecasting of cash flow and financial health.

Automatic categorization & reconciliation features to reduce manual accounting work.

💰 Pricing Model:

SaaS / Subscription model with free trial.

There is mention of a “Start for Free” and a 14-day free trial.

🆓 Free Plan Details:

Free trial: 14 days, no credit card required (to test the features).

💳 Paid Plan Details:

Paid tiers unlock more full features: e.g. connecting more bank accounts, more historical data, forecasting, probably more usage/customization. (Exact price tiers less clearly listed in my sources.)

🧭 Access Method:

Web app via Nuvio’s website (nuvio.io).

Users connect their bank accounts, import financial transactions, possibly upload data or sync via API.

🔗 Experience Link: